How to Submit Form C-S in Metro Accounting System?

To submit Form-CS In Metro ERP's Accounting App, follow these steps:

1) Once logged in, navigate to the "Accounting" module by clicking on its icon in the main dashboard or by using the application menu.

2) Navigate to the IRAS > Form C-S Menu.

3) Click on the Create button.

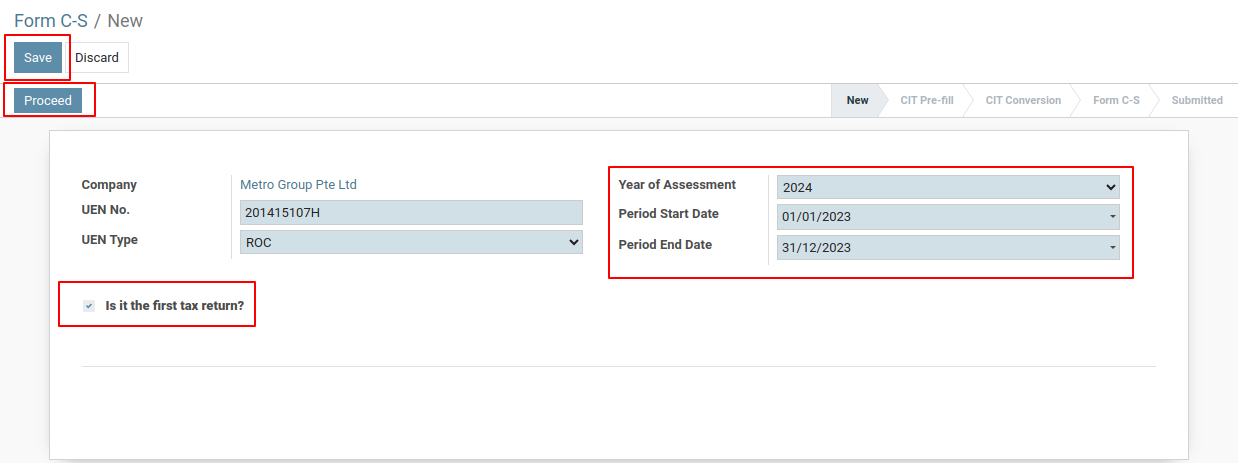

4) Enter the relevant details, such as the Year of Assessment, Period Start Date, and Period End Date, and mark the checkbox indicating whether it is the first tax return.

5) Click on the "Save" button to save the entered information.

6) Next, Click on the "Proceed" button.

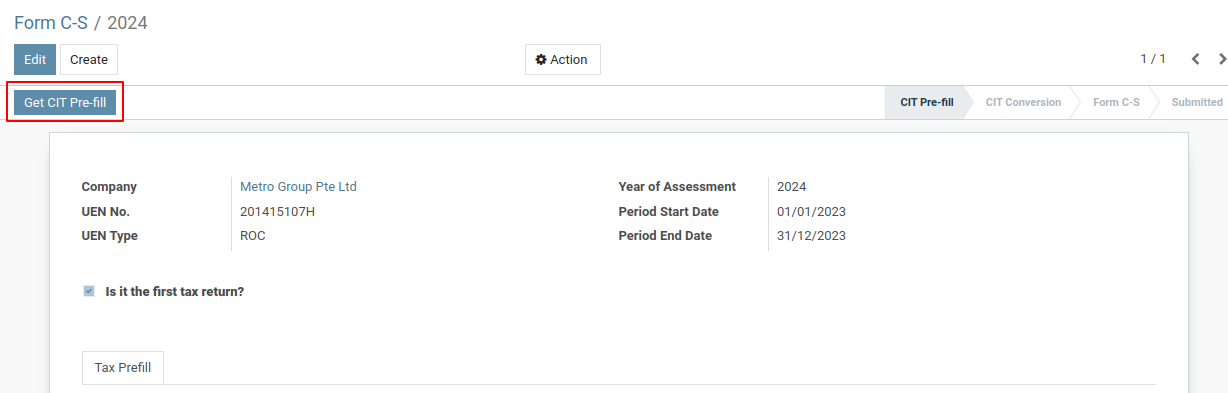

7) Then, click on the "Get CIT Pre-fill" button. This action will automatically fill in the information related to the company and redirect you to the SingPass site.

8) Login with your credential, and then it will automatically submit to the IRAS.

Certainly, let's break down the Form C-S/2024 screenshot based on Metro ERP tax compliance context:

Form Overview:

This is Form C-S/2024, a tax return form for companies in Singapore. It appears to be a tax conversion form, which means the company is transitioning from one tax regime to another.

Company Information:

- Company: Metro Group Pte Ltd

- UEN No.: 201415107H

- UEN Type: ROC (Registrar of Companies)

- Year of Assessment: 2024

- Period Start Date: 01/01/2023

- Period End Date: 31/12/2023

Key Sections:

- Is it the first tax return? - This section asks if this is the company's initial tax return.

- Tax Prefill:

- Tax Reference Number: This is for foreigners not eligible for Singpass.

- Tax Conversion:

- How many sets of financial statements did the company prepare for the period declared? - This asks how many sets of financial statements were prepared for the tax period.

- The financial year end of the first set of financial statements - This asks for the financial year-end date of the first set of financial statements.

- There is a change in the company's financial year end. The financial year end of the company before the change. - This section is for companies changing their financial year-end.

- Unutilized Capital Allowances brought forward - This asks for the unutilized capital allowances from the previous year.

- Unutilized Losses brought forward - This asks for the unutilized losses from the previous year.

- Unutilized Donations brought forward - This asks for the unutilized donations from the previous year.

- Current Year Donations - This asks for the donations made during the current tax year.

Overall Structure

The screenshot appears to be a detailed report, likely related to financial or business data. It seems to be organized in a tabular format with various sections and subsections.

Sections

Sections and Subsections

Without specific labels, I can only make educated guesses about the sections based on common financial report elements. Here's a breakdown of potential sections:

-

Header:

- Company Name: The name of the organization or business.

- Report Title: The specific title of the report, e.g., "Income Statement," "Balance Sheet," etc.

- Report Period: The time frame covered by the report, e.g., "For the Year Ended December 31, 2023."

-

Table Sections:

- Revenue/Sales: Details about the company's income from various sources.

- Cost of Goods Sold (COGS): The direct costs associated with producing or acquiring the goods sold.

- Gross Profit: The difference between revenue and COGS.

- Operating Expenses: Costs incurred in running the business, such as salaries, rent, utilities, etc.

- Operating Income: The profit or loss from the company's core operations.

- Other Income/Expense: Non-operating income or expenses, such as interest income, investment gains/losses, etc.

- Income Tax Expense: Taxes paid on the company's taxable income.

- Net Income: The final profit or loss after all expenses and taxes are accounted for.

Other Potential Sections:

- Balance Sheet: Shows the company's financial position at a specific point in time, including assets, liabilities, and equity.

- Cash Flow Statement: Tracks the inflow and outflow of cash during a specific period.

- Notes to the Financial Statements: Provides additional details and explanations for items in the main financial statements.

Data Interpretation

The numerical data in the table would represent the actual figures for the company's financial performance. For example:

- Revenue might show $10,000,000, indicating the total income generated during the period.

- COGS might show $6,000,000, representing the costs directly associated with generating that revenue.

- Gross Profit would then be $4,000,000 ($10,000,000 - $6,000,000).

Purpose of the Report

The purpose of such a report is to provide a clear and concise overview of a company's financial health. It helps stakeholders, such as investors, creditors, and management, to:

- Assess Financial Performance: Evaluate the company's profitability, efficiency, and overall financial strength.

- Make Informed Decisions: Use the data to make decisions regarding investments, loans, or strategic planning.

- Identify Trends: Analyze historical data to identify trends and potential future performance.

- Compare with Competitors: Benchmark the company's performance against industry standards and competitors.

Overview:

This screenshot displays the initial stage of filling out the Form C-S/2024 for the financial year 2023-24. It's a crucial form for companies registered in Singapore to file their annual income tax return.

Available Actions:

- Save: Saves the progress made so far in the form.

- Discard: Discards any changes made and returns to the previous state.

- Go Back: Navigates to the previous step or page in the form.

- Review: Reviews the entered information before proceeding to the next step.

- CIT Pre-fill: Automatically fills in some fields with pre-filled data from the Corporate Income Tax (CIT) system.

- CIT Conversion: Converts data from the CIT system to the Form C-S format.

- Form C-S: Opens the Form C-S for manual entry of information.

- Submitted: Indicates that the form has been successfully submitted.

Next Steps:

- Check the "Is it the first tax return?" box if applicable.

- Click on "CIT Pre-fill" or "CIT Conversion" to automatically populate fields with data from the CIT system.

- Click on "Form C-S" to manually enter the required information.

- Review the information and make any necessary corrections.

- Click on "Save" to save the progress or "Submit" to file the tax return.

Overall Context

The screenshot appears to be a tax return form, likely a Singapore Corporate Income Tax return (Form C-S). It's being filled out within the Metro ERP platform, which is an open-source enterprise resource planning (ERP) software.

The "View Acknowledgement" button in Metro ERP is a crucial tool for tracking the status of tax submissions. It provides a detailed record of the submission process, including the acknowledgement number, date, and time of submission, and other relevant information.

Functionality:

When a tax return is successfully submitted, the system generates an acknowledgement number. Clicking the "View Acknowledgement" button opens a new window or tab displaying the following details:

- Acknowledgement Number: A unique identifier for the submitted tax return.

- Date and Time of Submission: The exact timestamp when the submission was completed.

- Estimated Tax Payable: The calculated tax amount that is due to be paid.

- Other Relevant Information: Depending on the specific tax form and jurisdiction, there might be additional details such as:

- Whether the submission was done by the taxpayer or a third party.

- Any specific notes or messages from the tax authorities.

Response Data:

- Acknowledgement No.: (Empty)

- Date/Time: (Empty)

- Estimated Tax Payable: 0.00

Other Data:

- Submitted by Third Party other than Taxpayer: (This field is likely checked, indicating that the form is being submitted by a third party on behalf of the taxpayer.)

To get more details how to submit Form C-S, please do contact us at support@metrogroup.solutions