Daily Sales Outstanding (DSO) measures the average time your business takes to collect payments from clients after making a sale. Often referred to as "days sales in receivable," this metric offers insights into your payment collection efficiency.

Why Days Sales Outstanding Matters?

DSO is a key indicator of financial health as it directly impacts profitability and cash flow forecasting. By analysing DSO, you can identify bottlenecks in your accounts receivable process and anticipate cash flow fluctuations. High DSO could signal potential cash flow problems, prompting a review of credit policies and customer relationships. However, DSO should be considered alongside other performance metrics like the cash conversion cycle and accounts receivable turnover ratio for a comprehensive assessment of business health.

Calculating DSO

The formula for DSO involves dividing accounts receivable by total credit sales, then multiplying by the number of days in the measurement period. For instance, if your accounts receivable is $20,000 and credit sales amount to $10,000 over 30 days, your DSO is calculated as follows:

DSO= (Accounts Receivable / Total Credit Sales) ×Number of Days

DSO= (Total Credit Sales / Accounts Receivable) ×Number of Days

Impact on Business Finances Delayed payments can strain your finances by reducing revenue and hindering investment opportunities. As overdue accounts age, the likelihood of full collection diminishes, potentially impacting pretax income. Cash flow issues may arise, necessitating external financing and increasing interest payments.

Optimising DSO with Metro Accounting System

Introducing Metro Accounting System can streamline your accounts receivable process and improve DSO. Here's how:

Efficient Invoicing: Utilise Metro's invoicing features to promptly send invoices upon delivering products or services, expediting payment processing.

Invoice Templates: Customise invoice templates within Metro to include payment terms, due dates, and payment journals, ensuring clarity.

Diverse Payment Journals: Metro supports multiple payment journals, offering clients convenience and accelerating payment processing.

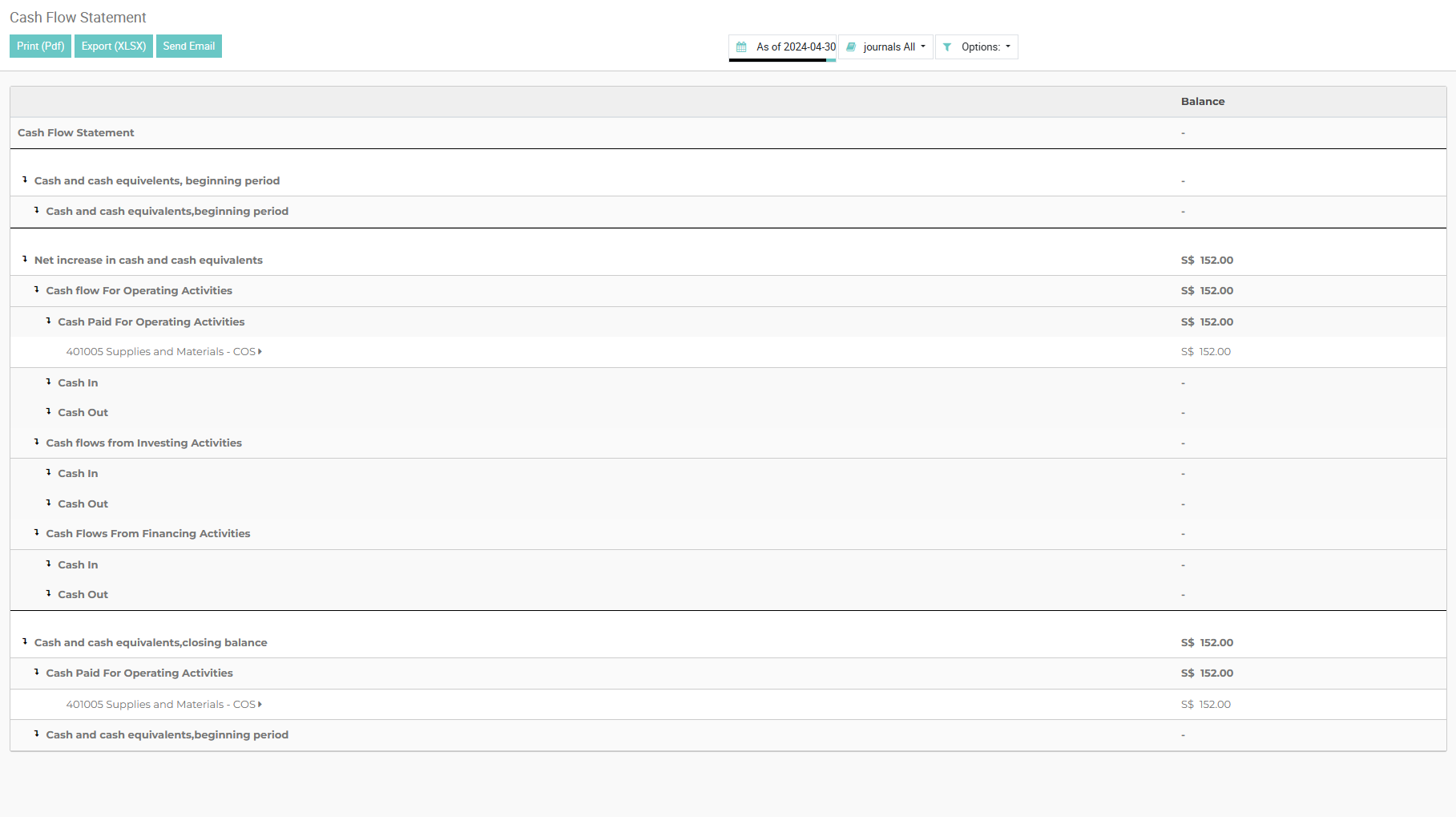

By integrating Metro Accounting System into your operations, you can enhance your accounts receivable management, reduce DSO, and improve overall financial performance. Metro Accounting System comes with detailed reporting of cash-flow statements.

In conclusion, monitoring and optimising DSO is essential for maintaining healthy cash flow and sustaining business growth.

Screenshot of Cashflow Statement

Screenshot of cashflow statement of Metro Accounting System