In recent years, the landscape of business transactions has been undergoing a significant digital transformation, and the Singaporean government has been at the forefront of promoting efficiency and transparency in tax administration through initiatives like InvoiceNow. In this blog post, we'll delve into what GST InvoiceNow is all about, its phased adoption, benefits, requirements, and steps for businesses to prepare early. Plus, we'll introduce how Metro Accounting System can seamlessly integrate with this system to streamline your tax compliance processes.

Understanding GST InvoiceNow

GST InvoiceNow, built upon the international standard Peppol, is a nationwide e-invoicing network introduced by the Infocomm Media Development Authority (IMDA) in 2019. It facilitates the seamless transmission of invoices between businesses in a structured digital format, reducing the need for manual processing and recording.

Phased Adoption Approach

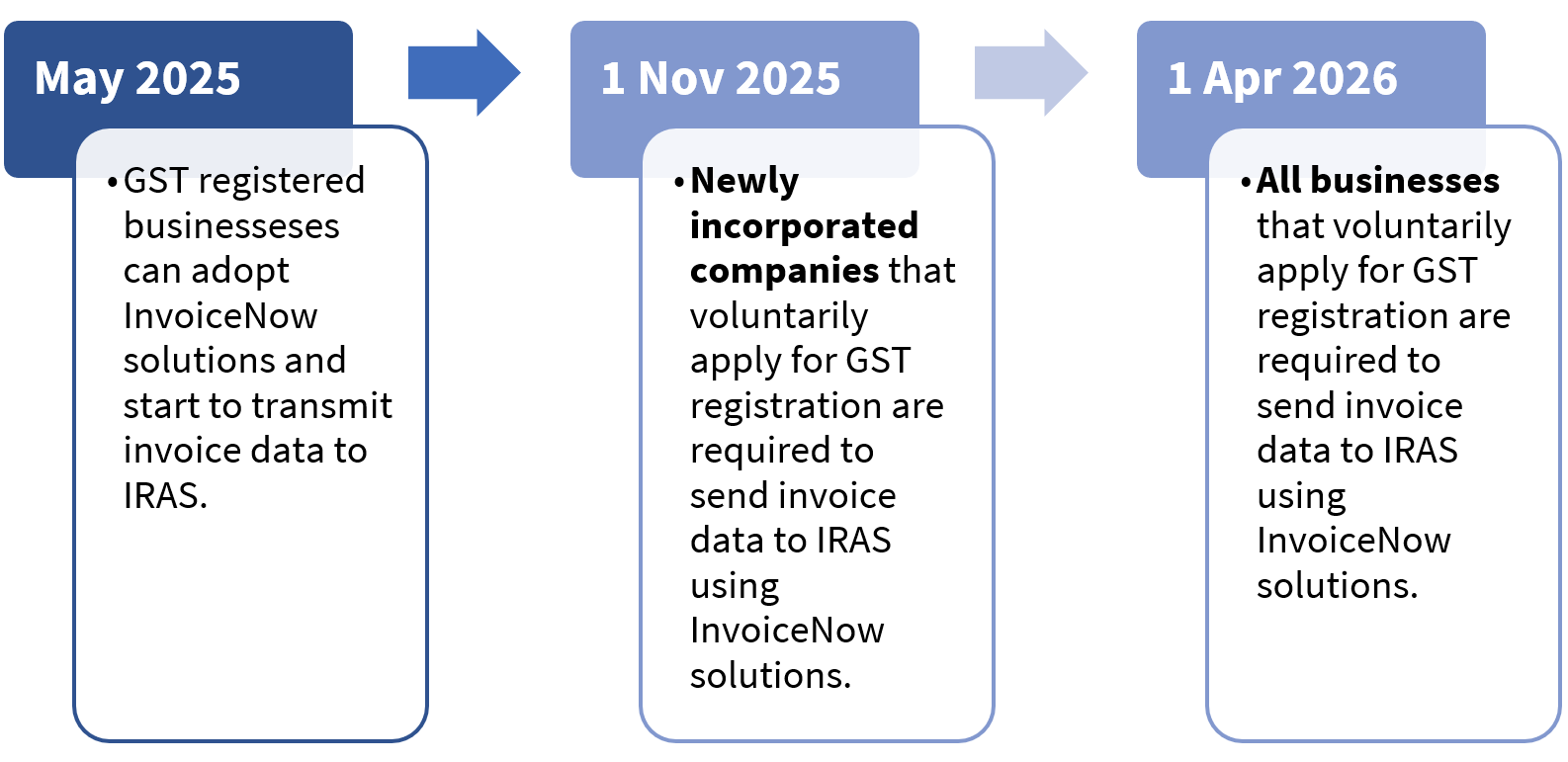

To ensure a smooth transition for businesses, the implementation of GST InvoiceNow is being rolled out gradually:

- Nov 1, 2025: Newly incorporated companies voluntarily registering for GST.

- Apr 1, 2026: All new voluntary GST registrants, irrespective of incorporation date.

- May 1, 2025: A soft launch for existing GST-registered businesses to voluntarily transmit invoice data to IRAS using InvoiceNow solutions.

Benefits of Using InvoiceNow Solutions

The advantages of adopting InvoiceNow solutions are manifold:

- Streamlined Processes: Direct transmission of e-invoices eliminates manual work.

- Reduced Errors and Costs: Automation minimizes errors and associated costs.

- Improved Cashflow Management: Quicker invoice processing enhances cashflow management.

Requirements and Scope

Businesses under the GST InvoiceNow Requirement must transmit invoice data to IRAS for transactions including standard-rated and zero-rated supplies, and standard-rated purchases. The due date for transmission is aligned with the filing of relevant GST returns.

Preparing Early for Adoption

To prepare for the adoption of InvoiceNow solutions, businesses are advised to follow these steps:

- Ensure Solution Compatibility: Check if your accounting solution is InvoiceNow-enabled or connect with an IMDA pre-approved Access Point Provider.

- Register for InvoiceNow: Obtain your Peppol ID through your Solution Provider and/or Access Point Provider.

- Connect to IRAS: Ensure your InvoiceNow solution is connected to IRAS via API.

- Activate and Test: Enable the feature to transmit invoice data to IRAS and conduct system tests for successful transmission.

Introducing Metro Accounting System

Metro Accounting System offers a robust solution for businesses aiming to seamlessly integrate with GST InvoiceNow:

- Ensure Compliance: Metro is InvoiceNow-enabled, ensuring seamless transmission of invoice data to IRAS.

- Streamline Processes: Automate invoicing, recording, and reporting, reducing manual efforts.

- Enhance Accuracy: Minimise errors and rectification costs through Metro’s advanced features.

- Seamless Integration: Metro seamlessly integrates with InvoiceNow solutions, providing a hassle-free experience for businesses.

In conclusion, embracing GST InvoiceNow is not just about compliance; it's about leveraging technology to streamline operations, reduce costs, and enhance efficiency. By partnering with Metro Accounting System, businesses can navigate this digital transformation with ease, ensuring seamless integration and compliance with regulatory requirements.

Prepare your business for the future of tax administration with Metro Accounting System. Contact us today to learn more about how we can support your journey towards GST InvoiceNow compliance.